New Debao people pursue the concept of high quality and technology leading.

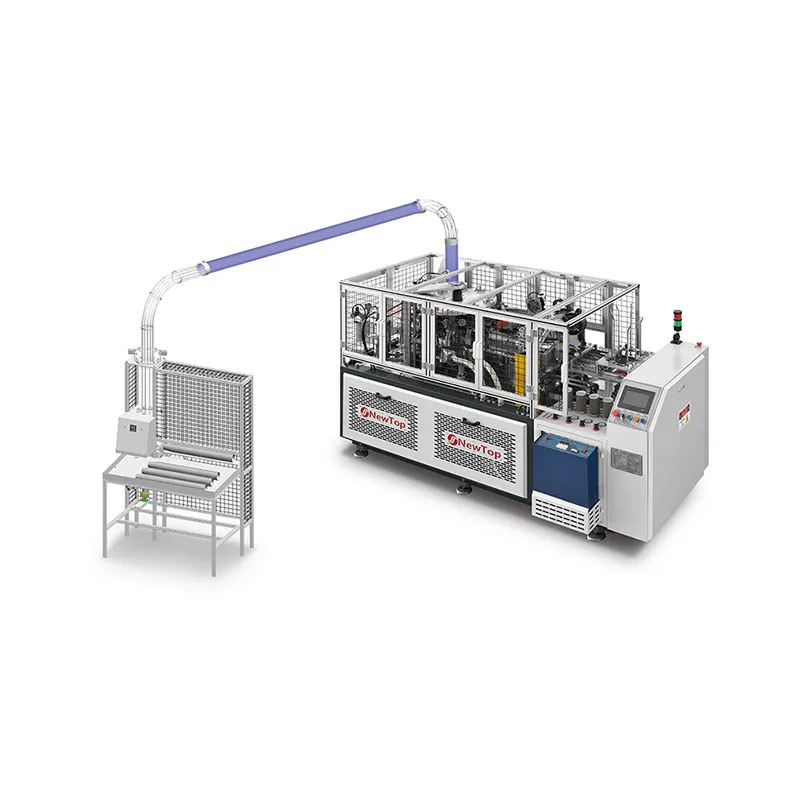

By changing the working mode with intelligent paper cup machine to make the operation more and more simple.

The global paper cup machine market has experienced steady growth driven by environmental policies phasing out single-use plastics, the expansion of food delivery services, and increasing hygiene awareness worldwide. With key manufacturing hubs in China, Taiwan, and Europe, international buyers face a complex landscape when sourcing these specialized machines. This guide provides a comprehensive, authoritative framework for procurement decision-making across different buyer tiers and procurement stages, incorporating international standards (GB/T 38087-2019, CE certification), technical specifications, and commercial considerations to ensure informed purchasing decisions that align with specific operational requirements and strategic objectives.

The paper cup machine industry serves a diversified global market with varying requirements across regions. Developed markets in North America and Europe primarily demand high-speed, automated machines compliant with strict safety standards, while emerging markets in Southeast Asia, Africa, and Latin America often prioritize cost-effective solutions with operational flexibility. The industry has seen technological convergence with advancements in IoT integration, predictive maintenance capabilities, and energy-efficient designs becoming standard among premium manufacturers.

The paper cup manufacturing ecosystem consists of upstream raw material suppliers (paperboard, PE coating), machine manufacturers and downstream converterswho produce finished cups for various end-use sectors. Geographic clusters have emerged, with significant manufacturing concentrations in China's Zhejiang province (Wenzhou, Ruian) and Taiwan, supplying both domestic and international markets. These regions offer competitive advantages through integrated supply chains and technical expertise developed over decades.

International buyers must navigate varying regulatory requirements across target markets. Key standards include:

GB/T 38087-2019: Chinese national standard for paper cup (bowl) forming machines, specifying technical requirements, testing methods, and safety protocols

CE Marking: Mandatory for machines sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards

Food Safety Compliance: Materials contacting food must meet regulations such as FDA (USA) and EFSA (Europe) requirements

Profile Characteristics: These buyers typically operate with limited capital ($10,000-30,000 equipment budget), often entering niche markets or local supply chains. They prioritize basic functionality,ease of operation, and minimal maintenance requirements over production speed or advanced features.

Strategic Priorities:

Budget Optimization: Focus on total cost of ownership rather than just purchase price

Operational Simplicity: Seek machines with intuitive controls and minimal training requirements

Flexibility: Ability to produce multiple cup sizes (2.5-12 oz) without complex changeovers

Supplier Reliability: Preference for manufacturers with proven track records in their target regions

Table: Technical Requirements for Tier 1 Buyers

| Parameter | Specification Range | Rationale |

|---|---|---|

| Production Speed | 45-80 cups/minute | Balanced speed and stability for small batches |

| Power Requirements | 3.5-4 kW, 380V/220V 50HZ | Compatibility with standard industrial power |

| Machine Footprint | 2-2.5m (L) × 1-1.2m (W) | Space constraints in small facilities |

| Automation Level | Semi-automatic with basic functions | Reduced complexity and lower maintenance needs |

| Price Range | $10,000-20,000 | Alignment with limited capital availability |

Profile Characteristics: These established businesses are expanding operations to meet growing demand, with equipment budgets of $20,000-60,000. They require machines offering higher production speeds,consistent quality, and moderate automation to improve operational efficiency.

Strategic Priorities:

Performance Consistency: Prioritize machines with proven reliability and minimal downtime

Quality Output: Focus on cup consistency and reduction of defect rates

After-Sales Support: Require responsive technical support and spare parts availability

Scalability: Consider future expansion capabilities in machine design

Table: Technical Requirements for Tier 2 Buyers

| Parameter | Specification Range | Rationale |

|---|---|---|

| Production Speed | 70-120 cups/minute | Increased output for growing order volumes |

| Paper Grammage Range | 180-350 gsm, single/double PE | Material flexibility for diverse product lines |

| Control System | PLC with HMI interface | Improved process control and monitoring |

| Changeover Time | < 15 minutes for size changes | Reduced downtime between production runs |

| Price Range | $20,000-40,000 | Balance between performance and investment return |

Profile Characteristics: These buyers operate multiple production facilities globally, with sophisticated procurement processes and budgets exceeding $50,000 per machine. They demand high-speed automation, integration capabilities with existing lines, and comprehensive data collection features.

Strategic Priorities:

Production Efficiency: Maximum throughput with minimal operational intervention

Quality Assurance: Advanced inspection systems and statistical process control

Global Standards Compliance: Adherence to international safety and quality standards

Lifecycle Cost Optimization: Focus on long-term reliability and maintenance costs

Table: Technical Requirements for Tier 3 Buyers

| Parameter | Specification Range | Rationale |

|---|---|---|

| Production Speed | 200-300+ cups/minute | Economy of scale for large-volume production |

| Automation Features | Automated blank feeding, counting, stacking | Labor reduction and consistent output |

| Data Integration | IoT connectivity, OEE monitoring | Production analytics and predictive maintenance |

| Quality Control | Vision systems, automatic rejection | Consistent quality with minimal waste |

| Price Range | $50,000-150,000+ | Investment justified by production volume and reliability |

Requirements Definition

Begin with a comprehensive needs analysis that aligns with business objectives. Document specific technical requirements including:

Product Specifications: Cup sizes (diameter, height, capacity), paper weight range (180-350 gsm), and PE coating requirements (single/double)

Production Capacity: Target output (cups/minute/shift) with consideration for future growth

Facility Constraints: Available space, power supply (380V/50Hz standard), compressed air, and operational environment

Quality Standards: Acceptable defect rates, cup consistency tolerances, and compliance requirements

Budget Planning and TCO Analysis

Develop a comprehensive budget that extends beyond the initial purchase price to include:

Installation Costs: Foundation preparation, utility connections, and commissioning

Training Expenses: Operator and maintenance technician training programs

Consumables and Energy: Projected costs for replacement parts, energy consumption (3.5-11 kW typical range), and compressed air

Maintenance Budget: Preventive maintenance contracts and spare parts inventory

Professional Insight: Conduct a thorough requirements workshop involving production, maintenance, and quality assurance personnel before engaging suppliers. For international purchases, factor in currency exchange risks, import duties, and logistics costs which can add 15-30% to the base equipment price.

Supplier Screening Criteria

Establish a multi-dimensional evaluation framework to assess potential suppliers:

Technical Capability: Review machine specifications, innovation history, and R&D investments

Quality Systems: Verify ISO certifications, quality control processes, and testing facilities

Financial Stability: Assess company longevity, financial health, and customer concentration

Export Experience: Confirm experience with international shipments, documentation, and customs compliance

Due Diligence Process

Implement a structured verification process for shortlisted suppliers:

Factory Audits: Conduct on-site or virtual inspections of manufacturing facilities

Reference Checks: Contact existing customers in similar markets or applications

Sample Evaluation: Request production samples from their machines for quality assessment

Documentation Review: Examine technical manuals, maintenance guides, and compliance certificates

Procurement Strategy: Avoid selecting suppliers based solely on price. The lowest bid often indicates compromises in materials, components, or manufacturing standards that result in higher lifetime costs. Instead, prioritize suppliers demonstrating technical expertise, responsive support, and long-term partnership approach.

Key Negotiation Points

Focus negotiations on creating mutual value rather than just price reduction:

Payment Terms: Structure payments to align with milestones (30% advance, 40% before shipment, 30% after installation)

Warranty Coverage: Negotiate comprehensive warranty terms (typically 12 months) covering parts and labor

Training Provisions: Include detailed training programs for operators and maintenance staff

Service Response Times: Establish guaranteed response times for technical support

Contract Safeguards

Ensure the purchase agreement includes protective provisions:

Detailed Technical Annex: Comprehensive specifications forming part of the contract

Acceptance Criteria: Clear performance tests and quality standards for machine acceptance

Penalty Clauses: Remedies for delayed delivery or performance shortcomings

Intellectual Property: Protection of proprietary designs and processes

Table: Critical Contract Elements for International Buyers

| Contract Element | Key Considerations | Risk Mitigation |

|---|---|---|

| Incoterms | FOB (Free On Board) preferred for export control | Clear delineation of risk transfer points |

| Payment Method | T/T (Telegraphic Transfer), L/C (Letter of Credit) | Balance of buyer and supplier security |

| Force Majeure | Defined circumstances excusing performance | Protection against unforeseen events |

| Dispute Resolution | Arbitration venue and governing law specified | Streamlined conflict resolution process |

| Spare Parts Policy | Guaranteed availability period (typically 5-10 years) | Long-term operational security |

Pre-Delivery Preparation

Execute a detailed readiness assessment before machine arrival:

Site Preparation: Ensure foundation, utilities, and environmental conditions meet specifications

Import Documentation: Prepare customs clearance documents, certificates of origin, and compliance declarations

Installation Team: Assign cross-functional team including maintenance, production, and safety personnel

Commissioning and Acceptance Testing

Implement a structured acceptance protocol:

Initial Inspection: Verify machine condition after unpacking, document any transit damage

Mechanical Assembly: Supervise erection and alignment per manufacturer's specifications

Power-Up Sequence: Systematic verification of electrical, pneumatic, and control systems

Production Trials: Extended run tests with various paper grades to verify performance

Quality Verification: Measure cup dimensions, seam integrity, and bottom leak rates

Quality Assurance: Conduct comprehensive acceptance testing before signing final approval. Key performance indicators should include: production speed consistency, noise levels, energy consumption, and product quality consistency. For international transactions, consider engaging a third-party inspection service for objective verification, particularly for high-value purchases.

Technical Risks

Implement strategies to address potential equipment failures and performance gaps:

Preventive Maintenance: Establish scheduled maintenance routines based on manufacturer recommendations

Spare Parts Inventory: Maintain critical spares to minimize downtime from component failures

Performance Monitoring: Implement statistical process control to detect performance deviations early

Supply Chain Risks

Develop contingencies for supply chain disruptions:

Alternative Material Sources: Identify backup suppliers for specialized papers and components

Local Technical Support: Establish service partnerships in your region for prompt response

Documentation Management: Maintain comprehensive machine documentation including drawings and manuals

Industry 4.0 Integration

Evaluate machines with digitalization capabilities for future upgrades:

IoT Connectivity: Sensors for monitoring machine health and production metrics

Data Analytics: Platforms for analyzing operational efficiency and maintenance needs

Remote Diagnostics: Capability for suppliers to troubleshoot issues remotely

Sustainability Trends

Anticipate evolving environmental regulations and consumer preferences:

Energy Efficiency: Machines with servo motors and energy recovery systems

Material Flexibility: Ability to process recycled content and alternative substrates

Waste Reduction: Features that minimize trim waste and production rejects

Navigating the paper cup machine procurement landscape requires a systematic approach that aligns equipment capabilities with business objectives across different buyer tiers. By understanding technical specifications, evaluating suppliers comprehensively, negotiating favorable terms, and implementing robust operational protocols, international buyers can make informed decisions that deliver long-term value. As the industry continues to evolve with technological advancements and sustainability initiatives, a strategic approach to procurement becomes increasingly critical for competitive advantage in the global marketplace.

The most successful procurement outcomes result from meticulous planning, cross-functional collaboration, and strategic partnership with suppliers who demonstrate technical expertise and commitment to customer success. By applying the framework outlined in this guide, buyers can navigate the complexities of international paper cup machine procurement with confidence, ensuring their investment delivers optimal returns throughout the equipment lifecycle.

2.5oz-12oz Paper Cup Size

175 pcs/min Max Capacity

5oz-16oz Paper Cup Size

150 pcs/min Max Capacity

2.5oz-10oz Paper Cup Size

158 pcs/min Max Capacity